Contents

Commodities and forex markets are dictated by macro-economic factors that cause demand and supply, trade and geopolitics. Moreover, commodities and currency are global markets, which lend investors insight into international affairs. Contracts for difference allow individual investors to trade an array of financial products such as indices and commodities without having to physically own them. It shouldn’t be even compared with gold as both have different investment attitudes. If gold is more focussed on stability, Forex is more towards profit and risk and therefore is best suited for risk-taking investors. Forex traders who understand currency marketplace have proved that right moves made at the right time can result in immense money in a short time.

This dollar price of gold can now be converted into INR at the current exchange rate of Rs.66/$… To understand gold futures trading, first you must understand global Spot Gold.. You can hedge your forex investments to protect it from any political or event-based risk. CFDs have become a popular form of investment amongst individual investors as they allow the use of leverage. This results in maximizing your purchasing power by up to 400 times while only risking your initial investment.

AU is the code for Gold on the Periodic table of elements, and the price above is Gold quoted in US Dollars, which is the common yardstick for measuring the value of Gold across the world. Usually, US Treasury rates and gold prices have an inverse relation. When the US Treasury rates move up, gold prices tend to move down; and when US Treasury rates move down, gold prices tend to move up. As seen in the above chart, gold price has been following a seasonal pattern since 1973. In the months of January, February, September, November, and December, the price of gold tends to move higher than average. So, as per historical data, these months are good for going long on gold.

Advantages of Buying Gold Through MCX

Precious metal markets tend to do better in economic conditions where inflation is on the rise. Hence, any major changes in the value of the dollar will have a sizeable impact on prices of metals like gold, silver and platinum. When dollar falls, precious metals are a good place for investors to store USD which tends to drive their prices higher. Sugar, cotton, coffee, cocoa, soybeans, black pepper, castor seeds and cardamom are among agricultural produce in which traders invest. Bullion refers to precious metals such as gold, silver and platinum.

In order to learn more about investments in different market, keep following Nirmal bang. At any point of time there are 6 monthly gold commodity contracts that are available for trading. The gold futures contract will expire on the 5th day of each calendar month and a total of 6 months of gold contracts will be available.

After this MA crossover, the prices of gold rallied significantly over the next few months. In fact, gold gave one of the best returns in 2020 as compared to the previous many years. Before an investor invests in gold, he needs to have an understanding of the different factors which play a role in affecting the price of gold. Without knowing these factors, their investments may not prove to be profitable to the maximum degree.

Price is currently encountering triple intersection of following lines and creating strong bearish candle. Slope Frequency line However, the minor price flow approaching the tri-junction is displaying an organized can a black box be destroyed flow and has broken the previous minor high, which means there are some market manipulators… Gold portrays the second consecutive monthly gain as it flirts with the $1,800 threshold in the last few days.

Find and select a broker – Brokering firms are the best way to enter the MCX and one should choose a firm which matches his/her ideals and aspirations. Any Grievances related the aforesaid brokerage scheme will not be entertained on exchange platform. Commodities can be traded with somewhat higher leverage than some securities.

By Peter Nurse Investing.com – European stock markets slipped lower Friday, with investors remaining wary as a brutal year marred by Russia’s war in Ukraine, soaring inflation, and the… A gold trader will usually buy whenever a short-term MA crosses a longer-term MA. For example, if a 50-day MA were to cross over a 100-day MA, a gold trader will take that as a buy signal and initiate a long trade.

The above sections showed how a short-term trader can trade by looking at gold seasonal pattern and how a long-term trader can trade by looking at US Treasury rates. However, whether you are a short-term or long-term trader, you can decide your entry point based on certain technical analysis parameters such as the moving average . The availability of precious metals and their increased need in the market is one of the main contributing factors for change in precious metal prices.

European stocks lower, ending a brutal year on a weak note

Quotations of Gold Instruments indicate the number of silver ounces, contracts on Oil, or contracts on index, which are required for the exchange for an ounce of gold. The result of trading in quoted assets is converted into the account balance currency. Between 2013 to 2016, the real interest rates in the US went down. During this period, gold prices saw a big rally from USD 800 to USD 1800 per ounce. Provide lightning-fast execution of your transactions so that you can get the highest advantage from even the smallest movement in precious metal prices.

Will help you gain access to educational materials, market data, industrial insights as well as risk management tips to help you fully understand the precious metals trade. The overall performance of economic sectors that depend on precious metals for use as raw materials can also have a marked effect on their value. And these trends tend to drive the market prices of these metals towards higher levels. Forex trade in India takes place through currency derivatives such as futures contracts, forex spots and forwards. Futures contracts mention the date, quantity and price at which currencies will be traded in the future. This method is used in the forex market instead of physically exchanging the currencies to trade.

This is why most market players tend to choose them as viable investments in times of economic or political unrest. Regime changes, wars, market movements and any forms of uncertainty always help to drive the value of precious metals towards the higher end of the spectrum. In addition, there is import duty on gold plus GST that is payable. Then, other levies, cess, bank charges and insurance costs will be added up to arrive at the spot price in India in rupee terms. This figure will also depend on the domestic demand and supply of gold and the seasonal fluctuations. To that if you add the cost of carry, you will get the futures price on which you get to trade gold futures on the commodity exchanges.

Financial Analyst

It is difficult to choose between forex and gold as these both are great trading options. It has been used for investment for many years and thus is a familiar avenue. It offers defence against market volatility and therefore is https://1investing.in/ best for investors who are seeking for minimal risks. The fact that it is a scarce resource with global appeal makes it even more alluring for investors who are seeking for stability and long-term gains on their investments.

- But if you are a long-term gold trader, you need to look at the US Treasury rates for the long-term gold price trend as part of your gold trading strategy.

- XAUUSD reflects current value of one ounce of gold expressed in US dollars.

- It is employed in a variety of fields, including space, medicine, technology, and dentistry.

- Reliable trading platforms are imperative for success in these trades.

- The overall performance of economic sectors that depend on precious metals for use as raw materials can also have a marked effect on their value.

- Forex is currently the biggest financial market in the world.

Learn what margin and margin requirements are; also see an example of how this type of trading works and learn the risks of investing this way. Before investing in Gold Futures, keep in mind that they are dated instruments with a set expiration date. These commodities cease trading prior to the agreed-upon settlement date. Before the settlement date, all transactions will be halted, giving people enough time to assess their existing situation. After you’ve received this money, you can log in and trade gold futures from 9 a.m.

There are a host of good reasons as to why you too should join into the treasure hunt that happens to be precious metals trading. Referred to as the ‘Safe-Haven’ by investors across the globe, precious metals allow traders to hedge their investments against all kinds of market movements. A gold trader can do a short-term trade based on gold seasonal pattern or a long-term trade based on the US Treasury rates. Once the trader decides whether they want to do a short-term or long-term trade, they can use technical analysis parameters and trading gold tips, such as moving averages to time their entry and exit. As the trader moves deep into gold trading, there are many other technical indicators that they can look at and frame a suitable gold trading strategy accordingly. The above section discussed how a short-term gold trader can use gold’s seasonal pattern to buy and sell gold in specific months of the year.

Zinc, Copper, Lead, Nickel etc. are some of the most prominently traded base metals. These are usually used in various industrial applications as well as for making alloys. Let you earn additional returns through referral schemes and similar programs related to commodities exchange trading. Are fully licensed and regulated – compliant with multiple market regulation authorities across the globe like the World Gold Council, National commodities markets and more.

Minimum Lot Size 1oz Gold & 50oz Silver

To begin, you must first open a commodity trading account with a registered broker. This transaction involves some risk because it is based on guesswork. There are no to rare gold price manipulations in the global markets.

Understand and weigh the pros and cons of all opportunities available. If you trade in currency derivatives, you can use it as a hedge against political and event risk. By Peter Nurse Investing.com — U.S. stocks are seen opening marginally higher Thursday, rebounding after the previous session’s selloff, although gains are likely to be limited as… Now let us now look at how the price of gold has moved in the month of January during specific years. Collection of import documents through Deutsche Bank offers you a hassle-free banking experience. Base metals are commonly occurring metals that are known to corrode, tarnish, oxidize or otherwise change their chemical make-up post reaction/exposure with other elements.

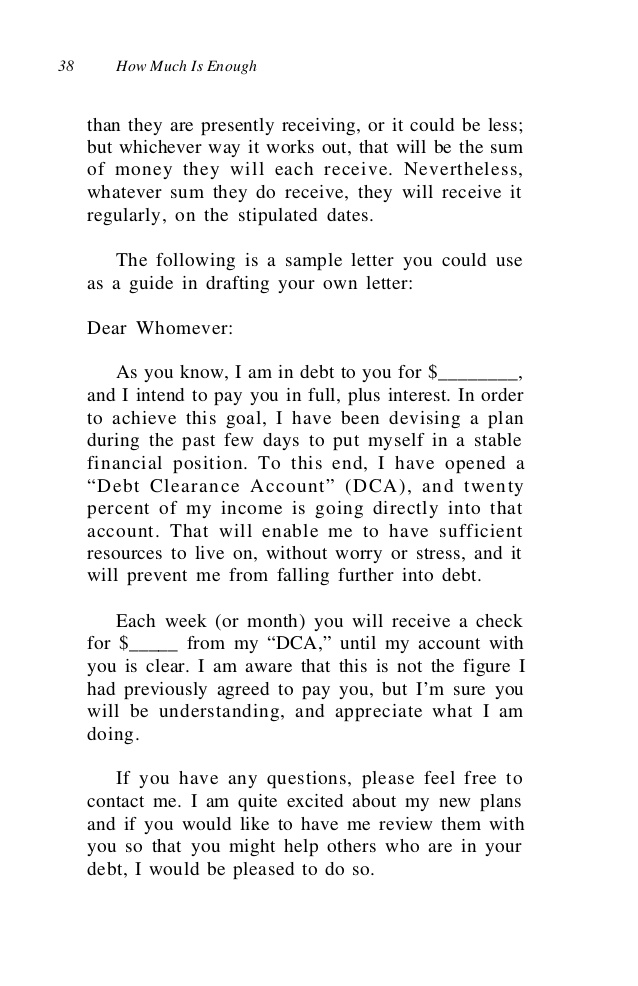

The fraudsters are luring the general public to transfer them money by falsely committing attractive brokerage / investment schemes of share market and/or Mutual Funds and/or personal loan facilities. Though we have filed complaint with police for the safety of your money we request you to not fall prey to such fraudsters. You can check about our products and services by visiting our website You can also write to us at , to know more about products and services.

Money transfer – One cannot trade until money is transferred to the broker. This amount can be transferred by DD, cheques, or net banking. Once this is done, an individual can log in to his/her account and participate in trade. Bombay Stock Exchange , United Stock Exchange and MCX-SX provide the marketplace for the sale and purchase of currencies.

You can also trade in Outright Cash, Outright Tom and Outright Spot on the FX-Retail platform. An extensive network of correspondent bank relationships with reputed international banks worldwide provides you with the facility of transacting anywhere, anytime. We will be happy to have you on board as a blogger, if you have the knack for writing. Just drop in a mail at with a brief bio and we will get in touch with you. Check your Securities /MF/ Bonds in the consolidated account statement issued by NSDL/CDSL every month. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 1, 2020.