The research showed that intrinsic motivation improved both prospecting and conversion efficacy. Gopalakrishna suggests looking for reps with long track records of success in similar roles. Such people are more likely than others to be drawn to sales for personal reasons rather than external rewards, such as the possibility of big bonuses or commissions. They’re also more likely to be intrinsically motivated than someone who has bounced from profession to profession before landing on or returning to sales. Intrinsic motivation is most important for experienced agents, because it counteracts the burnout arising from often-frustrating prospecting efforts. Resources that allow you to engage with those targeted lists via email can also add value to your account planning efforts.

It can help small and large teams by providing an actionable step-by-step guide for account managers, sales executives, and marketing professionals to collaborate within the account planning process. The most effective account managers and sales teams understand their customer’s narratives. They ask value-focused questions to get to the root of their customer’s business objectives, internal and external challenges, and industry landscape.

Implementing Account-Based Sales Process

That’s why resources to track the efficacy of your efforts are crucial. Supported by articles and academic resources, this template provides both questions to ask and cells to fill with relevant information. You will find yourself finishing your account plan in a blink of an eye. This guide is the best option for sales professionals who want to create effective sales strategies based on customer data.

Business is my passion and i have established myself in multiple industries with a focus on sustainable growth. This is why having a Sales account register will always be helpful to reproduce the transaction details whenever required.

Example of Purchases On Account

By using strategic account planning to target your key accounts, you can become your customer’s trusted partner by solving problems instead of selling products. As account-based selling has gained popularity in recent years, more and more companies are looking for ways to incorporate this methodology into their sales strategy. Content plays a key role in account-based selling, helping to identify and qualify potential customers, build relationships, and ultimately drive revenue.

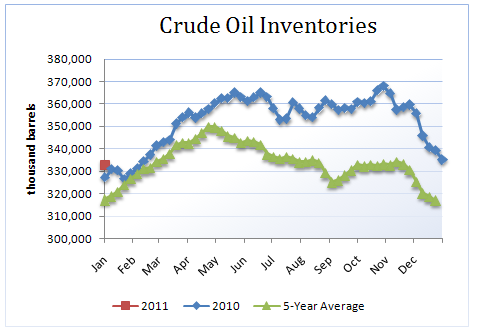

Double-Digit Sales Growth From Larger Tires is Easing Market … – PR Web

Double-Digit Sales Growth From Larger Tires is Easing Market ….

Posted: Mon, 26 Jun 2023 12:06:34 GMT [source]

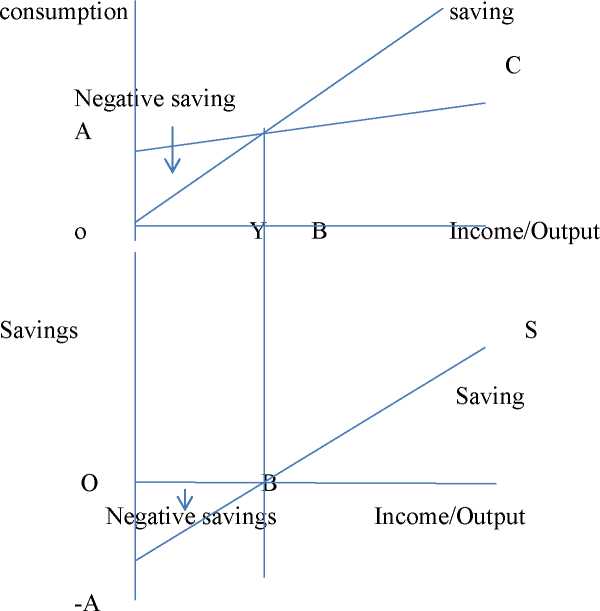

The format of account sales shown in the above example is pretty much simple. Sale revenue is an increase in equity during an accounting period except for such increases caused by the contributions from owners (equity participants). Sale revenue must result in increase in net assets (equity) of the entity such as by inflow of cash or other assets. However, net assets of an entity may increase simply by further capital investment by its owners even though such increase in net assets cannot be regarded as sale revenue. They’re responsible for achieving profitable sales targets for large retail stores like Walmart and Target. KAMs ensure that the demand from the account matches what the sales team has forecasted for the account so that consumers never find a store that’s out of Mountain Dew.

What is the Difference Between Sales Book and Sales Account?

To manage all of this, the company takes an account based approach to sales and account management. The role responsible for managing these relationships before, during, and after the sale is called the Key Account Manager (KAM). Consultative selling is a style of selling that focuses on building trust with the customer to understand their needs before recommending a specific product or service. Moving companies rely on B2C sales to connect directly with the consumer who uses their services. UPack uses digital ads to source leads which their B2C sales team turns into customers.

- Gopalakrishna and his team offer recommendations for sales managers looking to bolster their reps’ productivity.

- Another important use of a Sales Account is to keep a record of all transactions.

- We’ll go over the other two parts (short-term and long-term action items) in the next step.

Modelo Especial dethroned embattled Bud Light as the best-selling beer in the US last month, a new report says. Researchers from the University of Missouri studied the auto insurance industry to learn more about what drives sales success. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Ensure you have correctly defined and prioritized value opportunities and work with them to provide relevant materials or resources to secure buy-in. Although there may be many value-add opportunities, narrow your focus to a small subset. As former FBI hostage negotiator Chris Voss outlines in his book Never Split the Difference, all successful negotiations begin with listening.

Salesperson

One way or another, it’s always in your best interest to reach your target accounts in ways that suit their unique values and characteristics. Finding software to simplify that process can make your outreach more robust without losing focus. By reducing acquisition costs and speeding up sales, account planning can be the first step in successfully using your business resources, especially time and money. It provides the information needed to build solid foundations for your client’s relationships and your sales work. For example, if you sell software to businesses, you might create a blog post or white paper that discusses the benefits of your software and how it can help solve specific business problems.

- Resources that allow you to engage with those targeted lists via email can also add value to your account planning efforts.

- To develop a value-based action plan, you need to discover what your customer values most.

- Rounding out the top five in beer sales for May were Michelob Ultra, Coors Light, and Miller Lite, Circana reports.

- Closing B2B sales, especially enterprise sales, is a marathon and not a sprint.

- Okay, now that we got that out of the way, let’s jump into how to actually do the thing and work on a successful account planning process.

Understanding which companies are considered worthy of an account plan can be subjective, so it’s important to develop criteria for determining which companies to create an account plan for. As mentioned before, not all of your accounts necessarily need account plans. The value of account plans lies in their detail, and that detail requires time, energy, and sometimes, capital resources. As such, it makes the most sense to work account planning into strategic account management—or, in other words, focus your energy on your largest accounts. If you’ve ever been to an upscale restaurant where the host has detailed information about their most valued guests, you’ve seen a sales account plan in action.

Marketing is not only about putting your work out there but also about taking your audience’s language and communicating what they actually need to hear. Account planning is about partnering with your customer instead of selling to your customer. It looks at sales not as a transactional process wave integration but as the start of a strategic partnership. This term is usually applicable in B2B organizations rather than B2C organizations. Under the accrual basis or accrual method of accounting, goods sold on credit are reported as sales (revenue) when the goods have been transferred to the buyer.

Usually this occurs before the seller receives payment from the buyer. The sales on credit are recorded with a debit to Accounts Receivable and a credit to Sales. Plus, sales account mapping will help your sales team zero in on individuals who are higher up on the decision ladder or those who can help speed up the process. By providing relevant and targeted content in the right context, you can increase the likelihood of closing more business. By creating content that is relevant to your target market, you can reach a larger audience and generate leads that are more likely to convert into sales.